The Pradhan Mantri Awas Yojana (Urban) 2.0 plays a transformative role in helping India’s urban population access affordable homes. To ensure benefits reach the right families, the scheme categorises applicants into well-defined income groups — EWS, LIG and MIG. These categories determine eligibility for assistance, access to interest subsidies, and the type of housing a beneficiary can avail. Understanding these income brackets also helps applicants make informed decisions when assessing affordability through a Home Loan calculator or when evaluating their eligibility for a home loan subsidy under PMAY.

What are the PMAY Income Categories?

PMAY defines three income categories based on annual household income:

- Economically Weaker Section (EWS)- Income up to ₹3 lakh annually.

- Low Income Group: with income falling between ₹3 lakh and ₹6 lakh annually.

- MIG: ₹6-9 lakh per annum.

These definitions of income form the core of PMAY’s goals to ensure housing equity across various socio-economic segments in India.

Why Income Categories Matter

PMAY offers different benefits in various verticals. Income categories affect the correct distribution of these benefits, which are:

- Eligibility across PMAY components such as BLC, AHP, ARH, and ISS

- The maximum amount of home loan eligible for subsidy

- Interest subsidy calculations

- The property size and cost that a beneficiary can apply for

Most importantly, the income category determines the level of home loan subsidy under the Interest Subsidy Scheme, which helps lower EMI and improve long-term affordability.

EWS Category: Who Qualifies?

Households with an annual income of up to ₹3 lakh come under the EWS category. This category is one of the major focus areas for PMAY-U 2.0 and finds priority across most housing support verticals.

Benefits for EWS include

- Financial assistance for house construction through the Beneficiary-Led Construction (BLC) vertical

- Allotment of affordable homes under Affordable Housing in Partnership (AHP)

- Eligibility for a home loan subsidy under the Interest Subsidy Scheme (ISS), thus, a drastic reduction in the cost of borrowing.

EWS applicants usually know, before applying, how much loan amount is feasible based on expected subsidy and EMI by using a home loan calculator.

LIG Category: Bridging Affordability Gaps

Households with annual incomes between ₹3 lakh and ₹6 lakh come under the category of Low -Income Group. Many LIG families have moderate borrowing capacity; however, structured financial support is usually necessary to help the households access affordable housing.

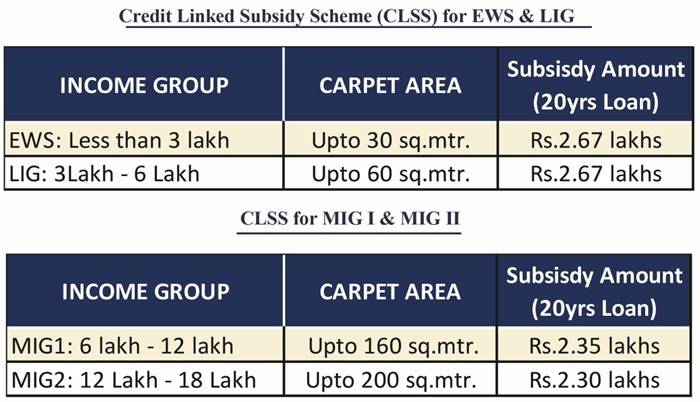

Under PMAY’s ISS vertical, LIG applicants receive the same subsidy structure as EWS—4 percent interest subsidy on the first ₹8 lakh of the loan amount, subject to scheme-specific limits on home loan and property value. The subsidy is credited to the loan account in instalments, reducing the effective EMI.

Since homeownership decisions for LIG families depend on accurate financial planning, a Home Loan calculator estimates the EMI before and after subsidy, thus helping to make better estimates of long-term affordability.

MIG Category: Middle-class support

The Middle-Income Group includes households earning between ₹6 lakh and ₹9 lakh annually. Even though MIG families may have a relatively stable income, rising property prices in urban areas make PMAY benefits extremely valuable.

Under ISS, MIG beneficiaries can avail the following benefits:

- Interest subsidy of 4 percent on the first ₹8 lakh of the home loan

- Eligibility for the maximum loan amount of ₹25 lakh under the subsidy

- Property value and carpet area limits as per the scheme.

The same support is especially useful for salaried or self-employed individuals in their purchase of affordable homes while keeping EMIs stable.

How Income Categories Affect Home Loan Eligibility

Since home loans are a major component of the PMAY benefits, income categories directly impact home loan eligibility and subsidy calculations. Here’s how income slabs influence the process:

- Subsidy entitlement is variable: only households within the defined income slabs qualify.

- Income influences loan size: The higher the income category, the higher the loan amount one qualifies for.

- EMI and repayment capacity depend on income. Applicants use a Home Loan calculator to understand how the subsidy reduces the monthly EMI.

- Property limits apply: Carpet area and property value caps vary between categories.

Understanding these factors will ensure that the beneficiaries choose the correct loan structure and property type in line with PMAY guidelines.

PMAY Income Verification Requirements

To avoid duplication and ensure accuracy, PMAY requires beneficiaries to submit:

- An income self-declaration or affidavit

- Aadhaar or Aadhaar Virtual ID for all eligible family members

- Proof of not owning a pucca house anywhere in India.

This applicant verification is done at the Urban Local Body (ULB) or district level, ensuring transparency in the selection of beneficiaries.

Grihum Housing Finance: Facilitating PMAY-led Homeownership

Grihum Housing Finance supports homebuyers aspiring to access PMAY benefits by offering products aligned with income-based eligibility norms. It simplifies the process of understanding subsidy entitlements, documentation, and loan feasibility, ensuring customers have clarity at every step.

Conclusion

The EWS, LIG, and MIG income categories form the backbone of PMAY-U 2.0, ensuring that housing benefits reach deserving families based on their financial capacity. These categories influence home loan subsidy eligibility, loan limits, property size, and overall affordability. With a clear understanding of where they stand, beneficiaries can use tools like a Home Loan calculator to evaluate their financial readiness and apply confidently under the scheme.

With the right guidance and structured support from Grihum Housing Finance, families can better navigate PMAY requirements and access housing solutions tailored to their income category. Through Grihum Housing Finance’s commitment to clarity and customer support, many homebuyers can take meaningful steps toward achieving secure and affordable homeownership.